Hi everyone,

This is Mr. Daniel, I hope everyone is having a great weekend. Welcome to this week’s newsletter.

I would like to share some of my thoughts on compound interest. One of the biggest news this week is the passing of the 3rd stimulus bill.

The 1.9 Trillion (1,900 Billion dollars) stimulus bill is passed to ensure continued economic recovery from the Covid crisis since March 2020.

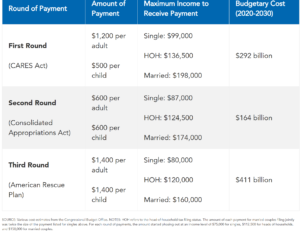

Part of the package is direct payment to Americans! Here is a quick summary of the 3 Rounds of direct payments to Americans.

If you are single, meeting the requirement to receive all 3 rounds of stimulus checks, you will receive a total of $3200 in stimulus checks from the IRS (Internal Revenue Services).

Let’s say you are 18 years old, getting ready to go to college, and are now working and making money for the first time.

You can put aside this $3200 and save to invest $100 per month for 30 years at 9% return (the average return for S&P 500 for the past 10 years is about 13.6%), you will end up with $200,000.

If you live frugally, work hard to save money by house hacking, and puts away to invest $600 per month for 30 years at 9%, you will end up with more than $1.0 million!

This is the power of compound interest. Each year, your principal (initial $3200) plus accumulated interests from the previous period is reinvested. When this happens for 30 years, the amount grows substantially.

As you start out in college and become financially independent, your biggest monthly expense is most likely to be on housing (mortgage payment, property tax, repair & maintenance). You can buy your first home with a 3-5% down payment and borrow the rest from a bank. Minimize your monthly payments by house hacking (buy a house & rent out other rooms to cover mortgage payments) and invest most of your income. If you save $1200 per month for 30 years at 9%, your investment can grow to more than $2.0 million.

Can you afford to save $1200 per month or $24000 per year?

This answer is YES.

Most of the American with modest salaries can. Figure out your total monthly spending and find out which area you can save (more on this in later articles). If you are determined to find ways to save on unessential expenses and be willing to delay gratifications (like fancy clothing, shoes, cars, and vacations), you can save $1200 per month.

You do not need to have the salaries of plastic surgeons or corporate CEO and make millions a year to achieve your goal. In other words, it is not about how much money you make, but rather how much you can save to invest.

Einstein famously said that compound interest is the most powerful force of the universe. If you believe in gravity and his theory of relativity, believe in how powerful compound interest is.

One thing about compound interest is that it takes time! A thing that teenagers have plenty of! To optimize the effect of compound interest is simply to start investing early.

Once again, compound interest takes time. We are not talking about months or years. It will take decades to see the effect of the compounding.

Warren Buffet, the wisest investor of our time said “If you don’t find a way to make money while you sleep, you will work until you die.”

Let money work for you through compound interest, don’t wait. Anytime is as good as gold! Start as early as you can.

Mr. Daniel

S&P 500 are the top 500 largest public-traded blue-chip companies in the United States. Like the FAANGs. (Facebook, Apple, Amazon, Netfilx, Google)

IRS – Internal Revenue Service – All working Americans need to pay taxes (Federal Tax, State Tax etc..) and file tax returns. IRS receives and enforces tax laws. It is the one agency you do not want to mess with.

Investment interest – If you invest $1000 at 9% return, you will have $1090 after 1 year, then $1188.1. You learned this in algebra II. Geometric sequence. Our example is not just a one-time investment but also include monthly $600 contributions so it is NOT

Inflation – this is the scariest invisible monster that eats up the value of your money. You can also define inflation as a general increase in prices and fall in the purchasing value of money. When I was 17 years old, a gallon of premium gasoline is $0.99. Now a gallon costs over $ 4.00. This is inflation. Your money will worth less as time goes on. This is why you do NOT put money in a savings account that pays you 0.5% interest when inflation is projected to hit 2% soon. Japan is the country with hyperinflation!

嗨,大家好,

我是丹尼爾,希望每個人都度過一個愉快的周末。 歡迎來到本週的新聞資訊。

我想分享一些我對複利的想法。 本週最大的新聞之一是第三次刺激法案的通過。

1.9萬億歐元(1.9萬億美元)的刺激法案獲得通過,以確保持續恢復自2020年3月新冠災情以來的經濟復甦。

該計劃的一部分是直接付款給美國人! 以下是對美國人的三輪直接付款的快速摘要。

如果您是單身,只要符合所有3輪刺激方案審核的要求,您就會從IRS(美國國稅局)收到總計3200美元的經濟紓困支票。

假設您今年18歲,準備上大學,現在第一次工作並賺錢。

您可以撥出這筆3200美元,節省下來並做投資,在30年內每月投資100美元,若以9%的回報率(過去10年中,標準普爾500指數的平均回報率約為13.6%),最終您將獲得200,000美元。

如果您生活節儉,你可以努力通過微型公寓來省錢,並以每月9%的價格投入每月600美元(為期30年),最終將獲得超過100萬美元的收益!

這就是複利的力量。 每年,您的本金(最初的3200美元)加上上一期間的累計利息就是再投資。 當這種情況持續30年時,數額將會大幅增長。

當您開始上大學並在財務上變得獨立時,您每月最大的支出很可能是用於住房(抵押貸款,財產稅,維修和保養)。 您可以先付3-5%的首付購房,然後再向銀行借錢。 通過微型公寓(購買房屋並出租其他房間以支付抵押貸款)的收益來減少每月最大限度地月付款,並將大部分收入用於投資上。 如果您在30年內每月節省1200美元(9%),您的投資將增長到200萬美元以上。

您負擔得起每月節省1200美元或每年節省24000美元嗎?

答案是肯定的。

中等收入的大多數美國人都是可以的。 找出您每月的總支出,並找出可以節省的部分(有關更多信息,請參閱後面的文章)。 如果您下定決心找出節省不必要開支的方法,並願意延遲享樂(如精美的衣服,鞋子,汽車和旅遊),那麼每月就可以節省1200美元。

您無需擁有整形外科醫生或公司首席執行官的薪水,就可以每年賺取數百萬美元來實現您的目標。 換句話說,這與您賺多少錢無關,而關乎的是您可以節省多少錢進行投資。

著名愛因斯坦講過,複利是宇宙中最強大的力量。 如果您相信他的引力及其相對論,那就請相信複利有多麼強大。

對於青少年的你們來說,關於複利這一件事是需要時間的! 只要儘早開始投資就能充分利用複利所帶來的結果。

再一次強調,複利是需要時間的。 我們不是在談論幾個月或幾年, 要看到複利的效果,將需要數十年的時間。

沃倫•巴菲特(Warren Buffet)是我們這個時代最明智的投資者,他說:“如果您在睡覺時找不到賺錢的方法,那麼您將一直工作到死。”

讓錢通過複利為您工作,請不要等待。 隨時都有黃金! 儘早開始。

丹尼爾先生

標普500指數是美國最大的500家最大的公開交易藍籌公司。 像FAANGs。 (Facebook,Apple,Amazon,Netfilx,Google)

IRS-國稅局-所有在職的美國人都需要繳稅(聯邦稅,州稅等)並提交納稅申報表。 國稅局接收並執行稅法。 這是您不想招惹的一個機構。

投資利息-如果您以9%的回報率投資$ 1000,一年後您將擁有$ 1090,然後是$ 1188.1。 您是在代數II中學到的。 幾何序列。 我們的示例不僅是一次性投資,還包括每月600美元的捐款,因此它不是

通貨膨脹-這是最可怕的隱形怪物,它會吞噬了您的金錢價值。 您也可以將通貨膨脹定義為價格的總體上漲而貨幣的購買價值下降。 當我17歲時,一加侖高級汽油的價格為0.99美元。 現在,每加侖汽油的價格超過$ 4.00。 這就是通貨膨脹。 隨著時間的流逝,您的錢將變得越來越少。 這就是為什麼您不將錢存入儲蓄帳戶中的情況,當預計通貨膨脹很快會達到2%時,該儲蓄帳戶將為您支付0.5%的利息。 日本是惡性通貨膨脹的國家!